The dynamic expansion of e-commerce and evolving consumer expectations have become focal points of opportunity for last mile logistics in Southeast Asia. The last mile industry presents numerous opportunities for businesses operating in the e-commerce delivery landscape.

Southeast Asia has witnessed a significant surge in e-commerce activities, with the total value of sales growing fivefold in three years, signaling a remarkable shift in consumer behavior. However, this growth comes with challenges, particularly in meeting the soaring demand for faster and more reliable e-commerce deliveries.

One significant challenge faced by e-commerce delivery is the high cost, constituting 53% of overall delivery costs. Additionally, the considerable bargaining power of e-commerce giants puts pressure on profit margins for last mile providers.

Innovative supply chain solutions are crucial to capitalize on the opportunities emerging in the e-commerce delivery space. Last mile providers must address the demand for cost-effective and efficient services, offering unique solutions to navigate e-commerce delivery challenges and establish a competitive opportunity in the market.

Source: https://ycpsolidiance.com/white-paper/logistics-last-mile-southeast-asia

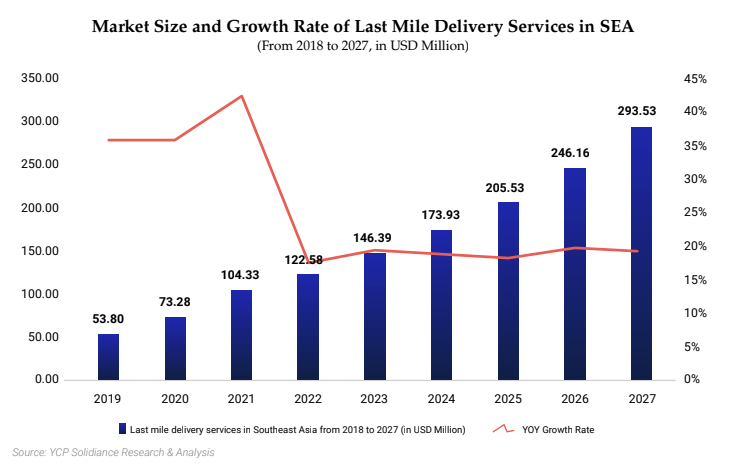

The last mile logistics in Southeast Asia witnessed robust year-over-year growth exceeding 30% from 2018 to 2021, and this growth trajectory continues aggressively at an annual rate of approximately 20%. Three key factors are pivotal in shaping Southeast Asia’s market trends in last mile logistics.

1. Growth in e-commerce fuelled by COVID-19: The pandemic accelerated the integration of digital commerce into consumers' lives in Southeast Asia. Lockdowns led to increased e-commerce spending, with the total value of sales growing fivefold from 2016 to 2021.

2. Consumer expectations driving demand: Consumers now expect fast, reliable, and convenient e-commerce deliveries. The last mile industry has advanced significantly to meet these expectations, focusing on same-day or next-day services, real-time tracking updates, and hassle-free returns.

3. Technology innovations: Technological advancements, including digital payments, automation, and artificial intelligence (AI), have streamlined logistics operations, improving customer experiences and shaping the competitive landscape.

However, challenges persist in the last mile logistics in Southeast Asia. The sector faces issues of low profitability, exacerbated by the bargaining power of e-commerce players. Even a slight decrease in delivery fees can represent significant savings for e-commerce giants, making it challenging for last mile providers to maintain competitive pricing and profit margins.

Low labor costs increase inertia for companies to pursue higher efficiency processes, hindering the adoption of automation. Additionally, a lack of skilled tech talent contributes to the slower adoption of new technological innovations.

Despite the challenges, the last mile logistics sector in Southeast Asia presents a wealth of opportunities for businesses willing to navigate the evolving landscape strategically. As the demand for e-commerce deliveries grows, last mile providers can capitalize on the following strategies.

1. Embracing digital transformation: Investing in digital payments, automation, and AI-driven solutions can enhance operational efficiency and address challenges related to the high cost of last mile delivery. Companies that swiftly adopt these technologies will gain a competitive advantage.

2. Sustainable initiatives: The growing interest in sustainability presents an attractive opportunity for last mile players. Businesses that provide ecological packaging and delivery choices can appeal to a rising category of environmentally conscious consumers.

3. Leveraging cold chain opportunities: The increased demand for last mile services extends beyond traditional e-commerce. Industries such as telemedicine and online grocery shopping are experiencing significant growth. Last mile providers can explore opportunities in cold chain logistics to cater to these emerging markets.

An Overview of Southeast Asia’s Startup Ecosystem

Southeast Asia’s startup ecosystem is characterized by its diversity and rapid growth. Key markets include Singapore, Indonesia, Malaysia, Thailand, Vietnam, and the Philippines. Each of these markets presents unique opportunities and challenges. Singapore, for instance, serves as a financial and technological hub, offering a conducive environment for startups with strong government support and a mature investment climate. Indonesia, with its large population, presents vast market opportunities, particularly in sectors like e-commerce and fintech.

How Major Players Unlock Opportunities in SEA’s Digital Payments Landscape

The digital payment landscape in Southeast Asia (SEA) is rapidly evolving, driven by increasing internet penetration, smartphone adoption, and a burgeoning fintech ecosystem. Major players in the digital payment space are pioneering innovative solutions, facilitating seamless transactions, and enhancing financial inclusion.

Key Drivers of Southeast Asia's Last Mile Logistics Market

The growth of last mile logistics market in Southeast Asia (SEA) is driven by various factors that are reshaping consumer expectations and industry dynamics. This article explores the key factors driving SEA's last mile logistics market, highlighting the convergence of digitalization, consumer demands, technological advancements, sustainability initiatives, and the development of e-commerce and essential deliveries.

Embracing Sustainability: The Rise of Sustainable Automotive Lubricants in SEA

In recent years, Southeast Asia (SEA) has witnessed a growing emphasis on sustainability across various industries, and the automotive sector is no exception. As the region gears towards a greener future, sustainable automotive lubricants have emerged as a key focal point in the drive towards environmental stewardship and resource conservation.