According to a recent industry report, C-suite and senior finance executives in Singapore are considering investing substantially in integrated finance, environmental, social, and governance (ESG) frameworks and blockchain technology developments in 2023. They are optimistic that these technologies will create new growth opportunities and give them an edge over rivals.

ESG presents a significant opportunity for financial services companies in Singapore to increase their market competitiveness, and 59% of respondents indicated that they are already working on new goods and services to take advantage of this chance.

According to the report, Singapore fintech executives are optimistic about DeFi, which refers to the distribution of financial assets with no requirement for intermediaries.

DeFi applications, which are frequently referred to as an alternative financial system, use blockchain technology and digital assets to handle monetary operations. Participants work together in a peer-to-peer network where the assets they represent can be automatically exchanged via so-called smart contracts.

More than half of Singapore’s fintech executives surveyed believe that DeFi gives a significant chance for their company to develop. According to 59% of respondents, DeFi will increase the ability of fintech firms and other disruptive competitors in the financial services industry to compete.

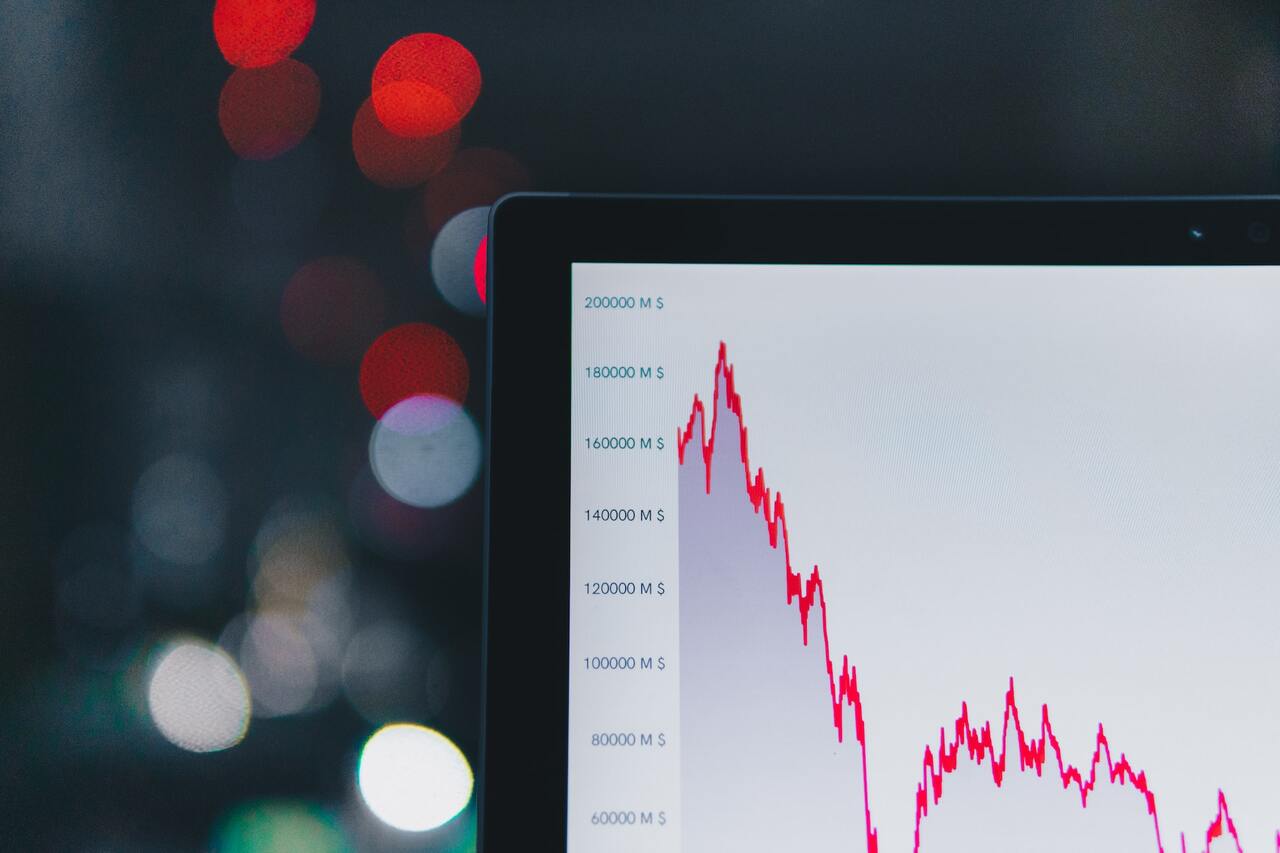

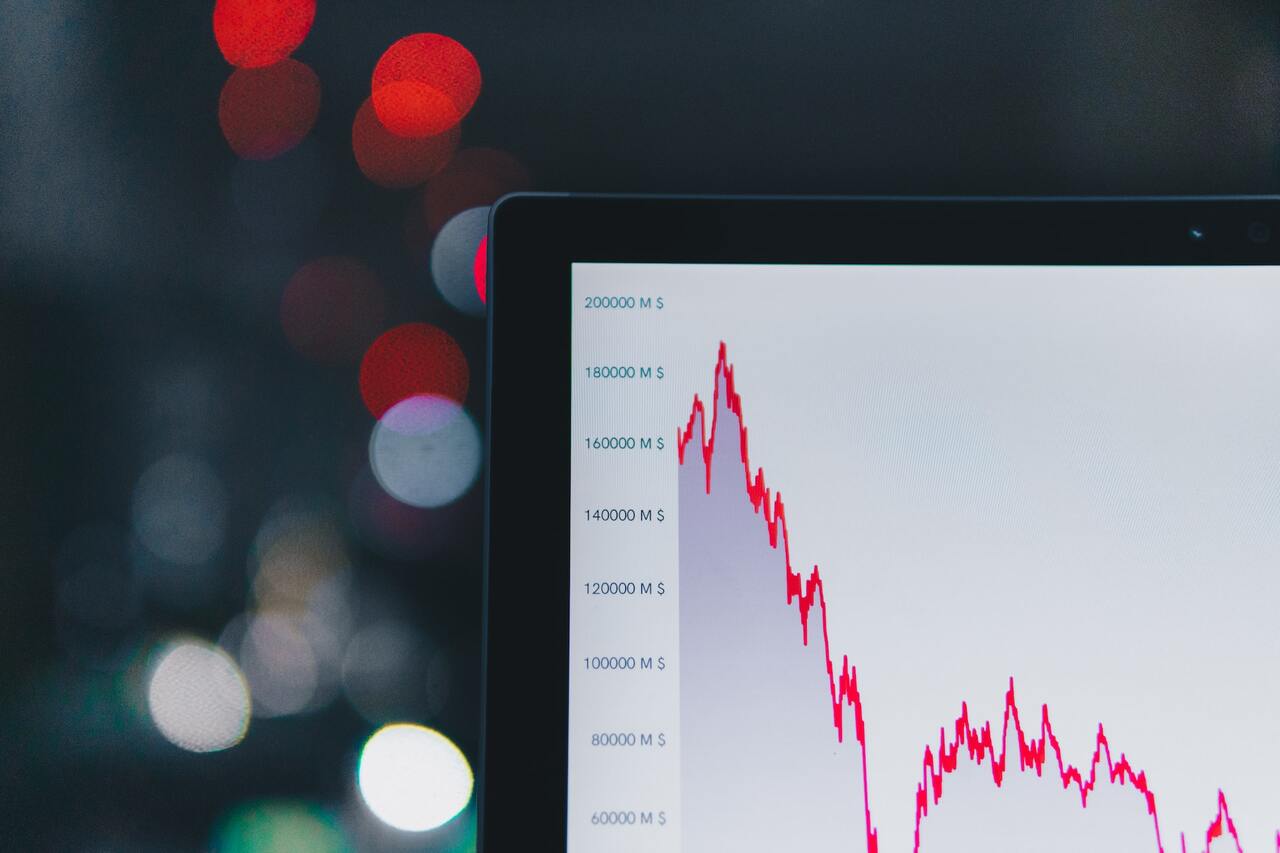

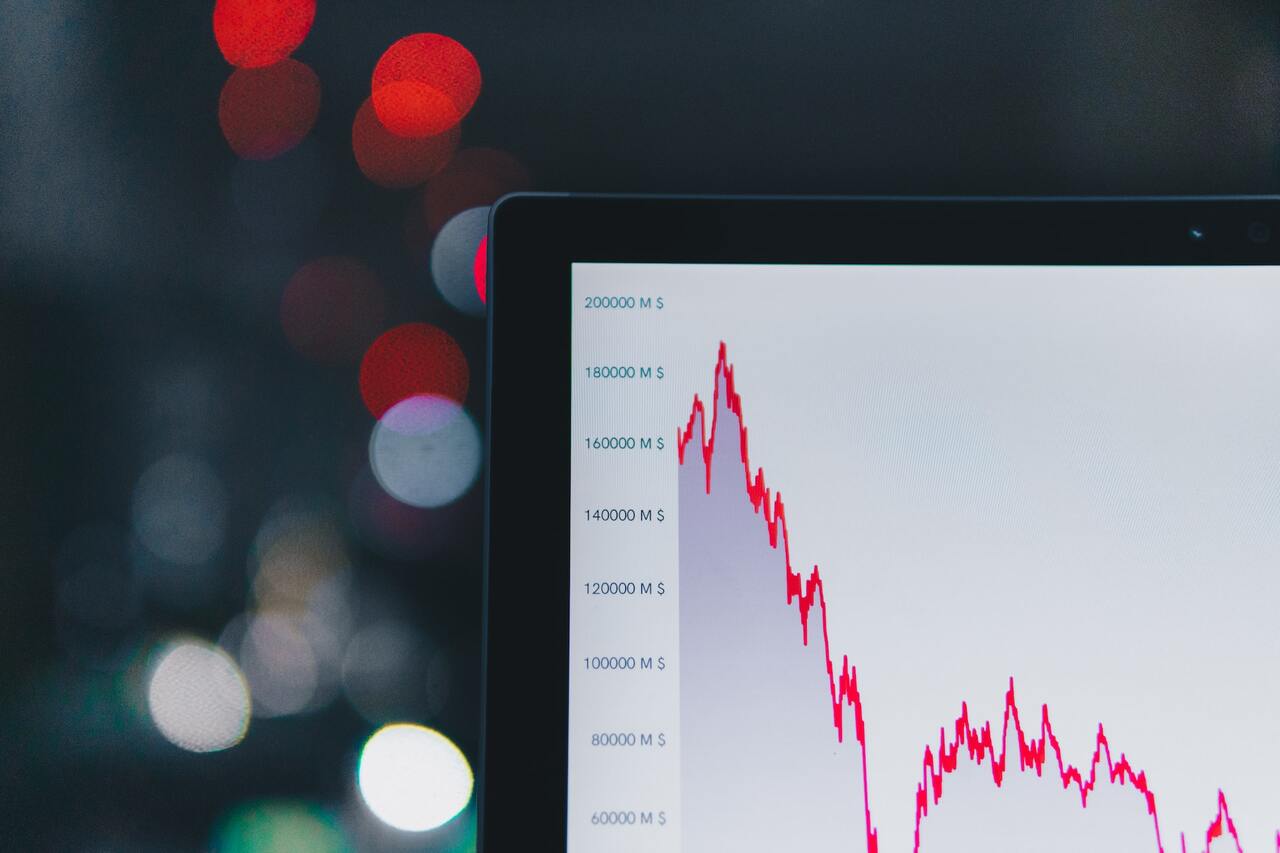

Despite the ongoing, protracted crypto winter, the blockchain and digital asset industries continue to experience innovation and adoption. He cited advancements in central bank digital currency (CBDC), greater organizational use of digital assets, and pilot projects involving underlying technologies as examples.

In Singapore, PayNow is the counterpart of UPI. Taking advantage of cooperating banks and other financial organizations, it permits peer-to-peer money transfers. Similar to how Indians can send and receive money through their mobile phone numbers thanks to the UPI system, users can send and receive money instantly from one bank or e-wallet to another by utilizing their cellphone number, Singapore National Registration Identity Card (NRIC)/Foreign Identification Number (FIN), or virtual payment address (VPA).

In order to allow Indian travelers to Europe to use their UPI and RuPay transaction methods for making foreign payments, the international division of the National Payments Corporation of India previously engaged into a cooperation with the Paris-based Worldline Payments. To facilitate the acceptance of UPI throughout the Emirati kingdom, NEOPAY, the fintech arm of Mashreq Bank in the United Arab Emirates (UAE), and NIPL joined in April 2022.

Based on current developments, advancements in Singapore’s fintech market have created waves of improvement for their economy and more can be expected as the country moves forward with their plans.

An Overview of Southeast Asia’s Startup Ecosystem

Southeast Asia’s startup ecosystem is characterized by its diversity and rapid growth. Key markets include Singapore, Indonesia, Malaysia, Thailand, Vietnam, and the Philippines. Each of these markets presents unique opportunities and challenges. Singapore, for instance, serves as a financial and technological hub, offering a conducive environment for startups with strong government support and a mature investment climate. Indonesia, with its large population, presents vast market opportunities, particularly in sectors like e-commerce and fintech.

How Major Players Unlock Opportunities in SEA’s Digital Payments Landscape

The digital payment landscape in Southeast Asia (SEA) is rapidly evolving, driven by increasing internet penetration, smartphone adoption, and a burgeoning fintech ecosystem. Major players in the digital payment space are pioneering innovative solutions, facilitating seamless transactions, and enhancing financial inclusion.

Key Drivers of Southeast Asia's Last Mile Logistics Market

The growth of last mile logistics market in Southeast Asia (SEA) is driven by various factors that are reshaping consumer expectations and industry dynamics. This article explores the key factors driving SEA's last mile logistics market, highlighting the convergence of digitalization, consumer demands, technological advancements, sustainability initiatives, and the development of e-commerce and essential deliveries.

Embracing Sustainability: The Rise of Sustainable Automotive Lubricants in SEA

In recent years, Southeast Asia (SEA) has witnessed a growing emphasis on sustainability across various industries, and the automotive sector is no exception. As the region gears towards a greener future, sustainable automotive lubricants have emerged as a key focal point in the drive towards environmental stewardship and resource conservation.